|

Today's Opinions, Tomorrow's Reality

Sinking Prospects By David G. Young Miami Beach, FL, October 18, 2022 -- Florida's latest real-estate boom is nearing its end. When the market drops, expect state politicians to stumble along with it. The forest of skyscrapers visible across Biscayne Bay serves as testament to Florida's red hot property boom. Last week saw groundbreaking for the Waldorf Astoria Residences, a planned 1,049 foot tower that will be the tallest south of Manhattan.1 Two other planned towers over 1,000 feet have received government approval2.

The current tallest building, the 850-foot Panorama Tower, was completed just over two years ago and stands near the second-tallest 817-foot Aston Martin Residences, which was topped off last November.3 A total of 31 different towers over 500 feet have been built in Miami since 2010, many of them in the booming Brickell neighborhood just south of the Miami river from downtown. Overwhelmingly, the space in these new towers are residential. Over 7,000 condos and apartments are planned or under construction in central Miami.4 The boom goes far beyond Miami. Across the state in Cape Coral, the population has more than doubled since 2010 to surpass 200,000 people5, turning the former swampland into the largest city between Tampa and Miami. Before gaining infamy from devastating floods wrought by Hurricane Irma, the community of single family homes attracted new residents from across the country hand over fist. The boom has been a godsend for Florida politicians led by Governor Ron DeSantis. Instead of making hard decisions about intractable problems, politicians can ride the waves of good times. Throw a little red meat at their constituents (think immigrant deportations, the infamous "Don't Say Gay" law, and anti-mask restrictions during the pandemic) and job security is assured. Recent polls show DeSantis leading his Democratic Party opponent, former Governor Charlie Crist, by double digits7. Last month, he even broke an all-time record for a gubernatorial candidate by raising $177 million.8 Much of this, of course, comes from donors in Florida's real estate industry9.

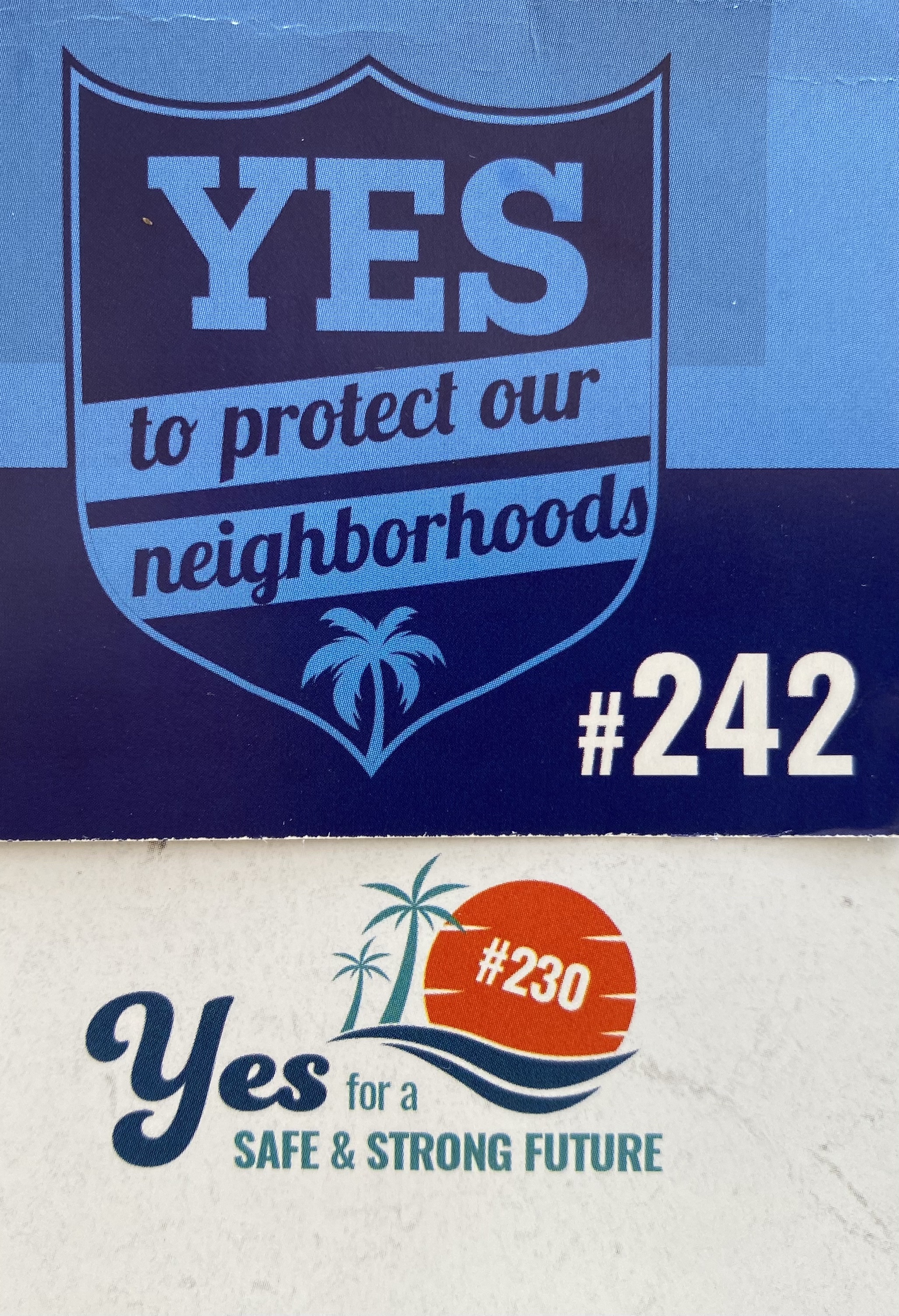

It's hard to state the importance of the real estate industry in Florida politics, as the two have been closely intertwined for over a century. This year's Miami Beach electoral ballot will feature eight referendums, most sponsored by real estate titans seeking to legally bulldoze building limits and feast on municipal bonds.10 The propositions are promoted by organizations with laughable names like "YES For A Safe and Strong Future" and "YES to Protect our Neighborhoods." But all is not well in paradise. Two big tempests loom on the horizon that could sink both Florida’s economy and DeSantis’ political future along with it. The first problem is caused by general market headwinds. Seven months of interest rate hikes have failed to tame stubborn inflation and will undoubtedly continue. This will depress demand for property nationwide as expensive loans reduce what many buyers can afford. In the past year, foreclosures in Florida have increased by 71%, and are now at the second highest rate after California9. Who will pay for those 7,000 new units coming online in the gleaming towers rising along Biscayne Bay? Who will take out newly expensive loans for homes on flooded construction sites in Cape Coral? Real estate booms rely on more buyers and renters to fill these new units and keep the real estate and construction industries going. As soon as the buyers bow out, the whole chain of new development collapses, and recession follows. This same process has happened repeatedly since the first Florida property crash in 1926. The next crash is inevitable as well -- it's a just a question of when. A second part problem on the horizon could accelerate this crash: Florida’s home insurance crisis. Even before the twin disasters of Champlain Towers and Hurricane Irma, the state's residential insurance industry was in crisis. The prevalence of insurance scams and lawsuits have seen many insurers pull out of the state. Florida alone accounts for 80% of property claims lawsuits in the United States and as a result, homeowner insurance rates have been rising 33% per year12 with many insurers falling into insolvency. Since lenders require insurance for a mortgaged properties, the growing insurance crisis could trigger a collapse even if general headwinds weren't there. Exactly when the boom will end is hard to predict -- but it likely won't be before the 2022 election just three weeks away. But 2024? That's another story. A landslide victory may make Governor DeSantis look like a shiny future president in waiting. But the next two years may tarnish his image like never before. Notes: 1. Profile Miami, Waldorf Astoria Hotel and Residences Miami Becomes First Supertall Tower to Break Ground in Miami, October 17, 2022 2. Miami Herald, After Waldorf Astoria, Miami’s First Supertall Tower, Here’s the Pipeline of Planned Towers, October 16, 2022 3. Florida YIMBY, Aston Martin Residences Tops Off At 816-Feet Over Downtown Miami, December 14, 2021 4. The Real Deal, Here are the Resi Projects Planned for Downtown Miami, September 2, 2022 5. US Census Bureau, Cape Coral Quick Facts, as posted October 18, 2022 6. US Census Bureau, Florida Quick Facts, as posted October 18, 2022 7. Five Thirty Eight, Who’s Ahead in the Florida Governor Race? as posted October 18, 2022 8. Open Secrets, Florida Gov. Ron DeSantis Breaks Gubernatorial Fundraising Record, September 16, 2022 9. Politico, DeSantis Campaign Taps Red-Hot Florida Real Estate Industry, April 20, 2022 10. Dolphns Owner Ross has Spent Over $1 million on Deauville Referendum in Mimi Beach, October 18, 2022 11. WFLA, Florida Foreclosures Increased 71% From 2021, October 13, 2022 12. NPR, Florida's Property Insurance Market was Already Under Stress. Ian Could Make It Worse, October 6, 2022 |